News

Is Nvidia’s Stock Price Supported by AI Growth, or is it Overvalued?

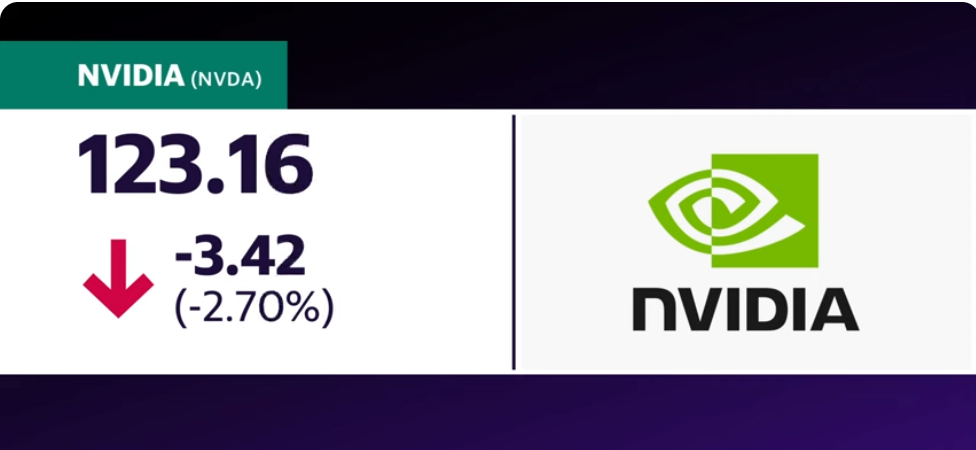

Nvidia’s stock price recently dropped nearly 7% over two trading days. This decline has sparked discussions about the future trajectory of the stock, particularly after Nvidia’s temporary lead as the world’s most valuable company. Investors are now evaluating whether to adjust their holdings in Nvidia (NVDA) and the broader AI sector, which has been a significant contributor to the S&P 500’s gains this year.

Contextualizing the Recent Dip

Nvidia’s stock price remains significantly higher year-to-date, despite the recent 7% decline. This drop is relatively minor when considering Nvidia’s historical volatility. In 2022, the stock price experienced a 66% decline, and there have been four instances of similar 15% or greater drops within the past year.

Investor Concerns

Recent developments are prompting investors to re-evaluate Nvidia’s stock price increase. The company’s achievement of the world’s most valuable company title during a slow economic period is one factor under consideration. Additionally, the concentration of large technology companies within major stock indexes and the strong performance of AI-related stocks in general have raised questions about potential overvaluation. These factors call for a more comprehensive analysis to determine whether Nvidia’s stock price reflects its true value or broader market trends.

Understanding Stock Market Bubbles

A stock market bubble typically involves rapid price increases that exceed reasonable valuations, widespread investor enthusiasm, and speculative behavior driven by a fear of missing out. Let’s examine Nvidia against these criteria.

Rapid and Substantial Price Appreciation

In the past 18 months, there has been significant growth in the stock prices of several AI companies. Nvidia, for example, has seen an increase of nearly 800% since early 2023. This trend is not unique to Nvidia, as other major players have experienced similar gains. However, Nvidia’s financial performance appears to support its current valuation. The company reported strong year-over-year revenue growth of 262% in Q1 of fiscal 2025, with data center revenue growing even faster at 427%. Additionally, Nvidia’s gross margins remain high at 78%, indicating continued profitability.

Valuation Perspective

Nvidia’s current one-year forward price-to-earnings (P/E) ratio of 47x is higher than several market indices, including the Philadelphia Semiconductor Index (35.9x), NASDAQ 100 Index (29x), S&P 500 (22.6x), and the equal-weight S&P 500 Index (17.8x). This indicates a premium placed on Nvidia’s stock price compared to its earnings potential. While Nvidia’s growth is strong, the P/E ratio suggests the stock may be priced above its current profitability. It’s important to note that the current market environment is quite different from the dot-com bubble, where P/E ratios for Nasdaq 100 stocks reached 200. However, the P/E ratio does highlight a potential difference between Nvidia’s stock price and its underlying business performance.

Speculation and Investor Sentiment

The options market provides some insights into investor sentiment for Nvidia. Currently, similar implied volatility for call and put options suggests a more balanced view compared to extreme optimism. However, discussions of AI as a productivity tool are on the rise, with 40% of S&P 500 companies mentioning it in their earnings calls. This increased focus on AI doesn’t necessarily equate to pure speculation, as its potential benefits for productivity are becoming more established. Additionally, the number of AI-related IPOs hasn’t shown excessive growth.

In 2024, $16 billion was raised through 88 IPOs, compared to the higher number of 154 in 2023. Notably, the peak for AI startup IPOs occurred in 2021 with 1035, suggesting this trend may have subsided in recent years.

What are your thoughts on it you can share your reviews in the comment section given below.