Guide

How to Calculate IRR in Excel

Having an understanding of an investment’s internal rate of return (IRR) makes it possible to plan for the investment’s continued development and growth in the future. Use the IRR algorithm available in Microsoft Excel 2019, Excel 2016, Excel 2013, Excel 2010, Excel 2007, Excel for Mac, Excel for Microsoft 365, and Excel Online to calculate those amounts.

Read Also: How to Enable Macros in Microsoft Excel

How to Calculate IRR in Excel

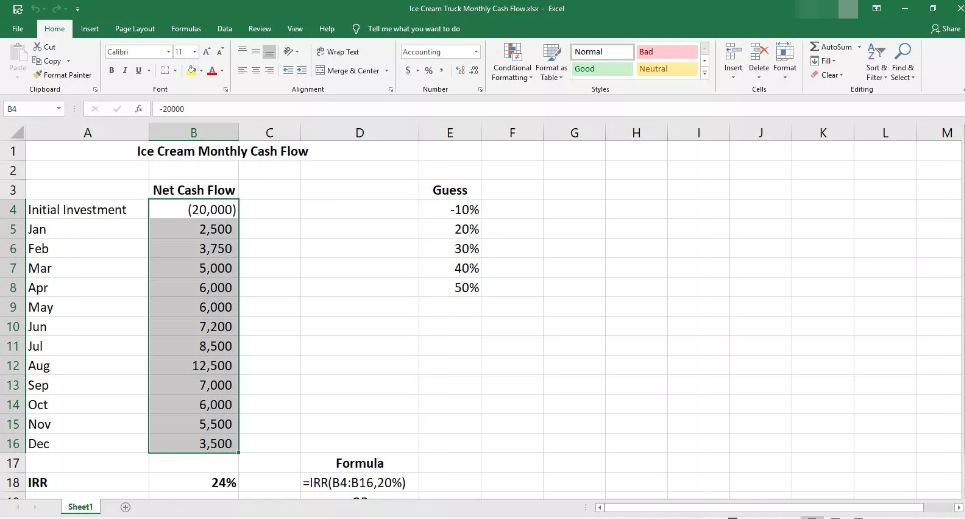

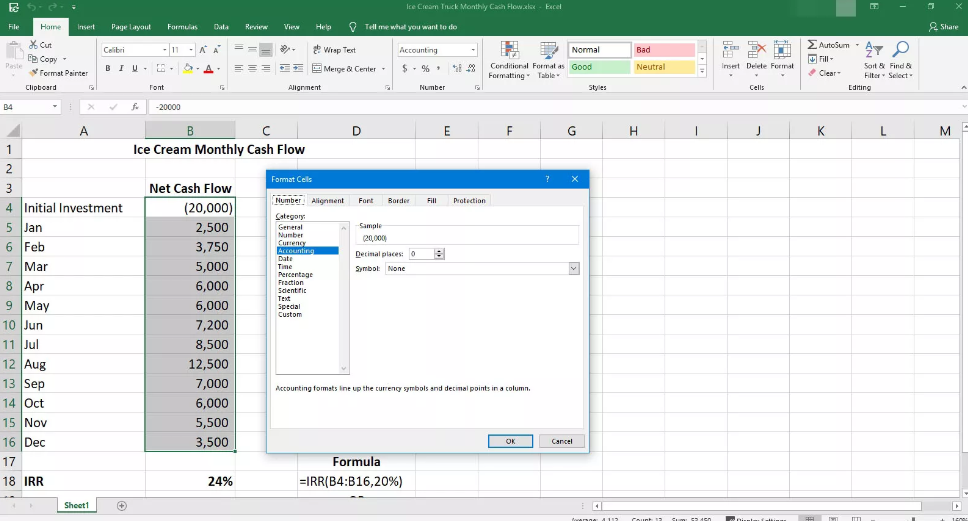

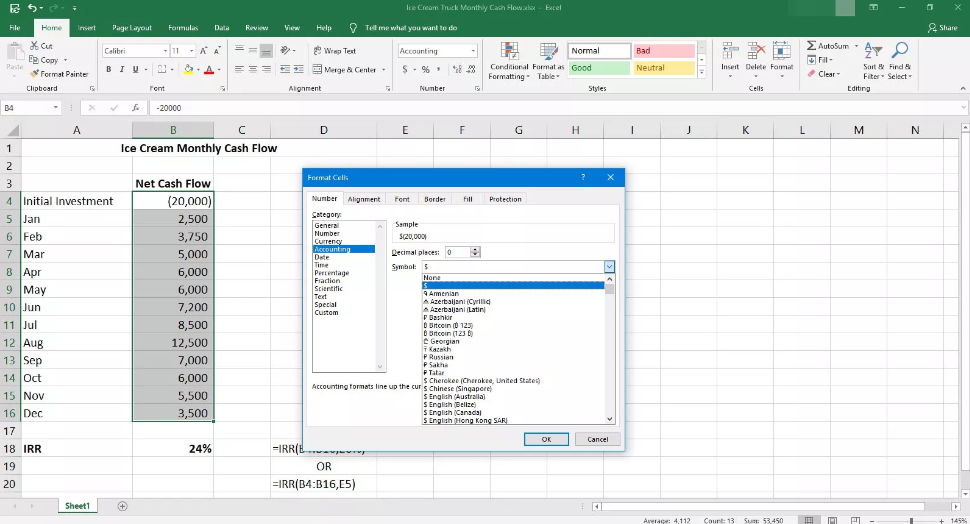

To get started, you will first need to verify that the format of the sequence of values for net cash flow in each of your entries is set to Number. This is an important step before you can move on to the next step. To accomplish this objective, carry out the following procedures:

1. Select the cells in which you want to make changes to the format or check the format of those cells.

2. After clicking the right button of the mouse, select the Format Cells option.

3. You have the option of selecting either Number or Accounting from the drop-down menu that is found in the tab labelled Number.

4. Select the OK button once you have finished making any format adjustments that may be required in the space to the left of the Category box.

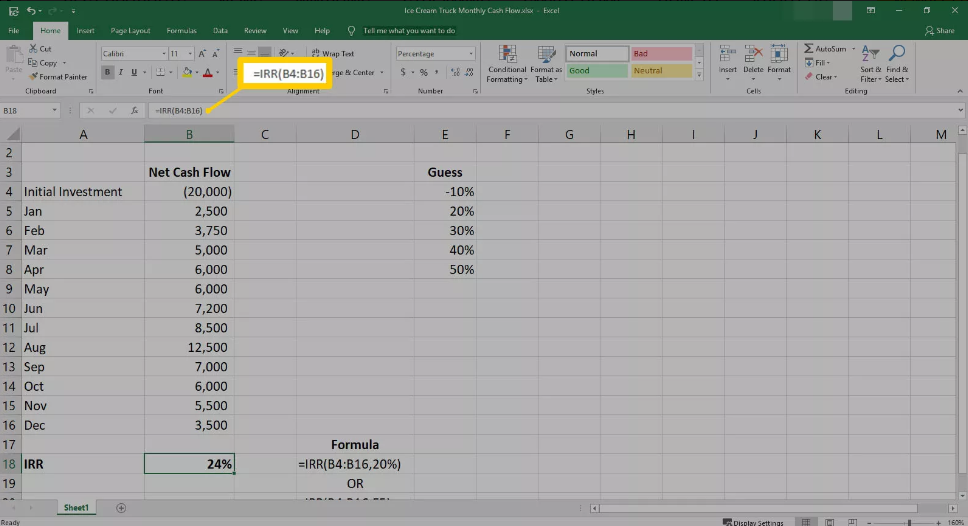

5. Select the cell where you want to insert the IRR value, and then enter the information that follows after you’ve made your selection:

In this particular illustration, the formula would look something like this:

6. After typing in the formula and formatting it to conform to your requirements, you need only press the Enter key to view the output of the calculation.

FAQs

What is the formula of IRR with example?

It is helpful to compare one investment to another using the internal rate of return (IRR), which is the rate of interest that results in the sum of all cash flows being equal to zero. If we take the example from earlier and change the 8% to 13.92%, the NPV will become zero, and that number represents your IRR. As a result, internal rate of return (IRR) is referred to as the discount rate at which the net present value (NPV) of a project becomes zero.

How do you calculate IRR manually?

Determine the present value of each amount, whether it is money coming in or money going out, and then add up all of the present values you have determined. Deduct the Present Values that you have to pay.

Are NPV and IRR the same?

What Do NPV and IRR Stand for? The difference between the present value of cash inflows and the present value of cash outflows over a specified amount of time is the component known as net present value (NPV). On the other hand, the internal rate of return, often known as the IRR, is a computation that is utilised to assess the future profitability of investments.

Is IRR same as ROI?

The difference between ROI and IRR is that ROI measures the overall growth of an investment from the beginning to the end, whereas IRR determines the annual growth rate. Over the course of one year, the two values will be relatively comparable to one another, but over longer periods of time, they will not be comparable.