Cryptocurrency

How to Ensure Good Crypto Liquidity on Your Platform? — 2024 Edition

The year 2024 is shaping up to be an exciting and pivotal time for the cryptocurrency market. As institutional investors begin to enter the space, experts predict a significant growth in demand for crypto trading services. Whether you’re a new or established business operating in this dynamic industry, having a reliable crypto liquidity provider will be crucial to your success.

But with so many options available, how do you choose the right one? In this article, we’ll take a closer look at what to consider when seeking out a crypto liquidity provider in 2024.

Crypto Liquidity Providers

Before we delve into the specifics of finding a crypto liquidity provider, let’s first define what exactly they are.

A liquidity provider is an individual or entity that facilitates liquidity in the crypto market. In crypto, these agents can be categorised into two groups:

- companies and institutions that provide liquidity for centralised projects

- users who fund liquidity pools in decentralised finance (DeFi) protocols with their funds

Institutional Liquidity Providers

Institutional liquidity providers play a crucial role in the financial markets, providing spot or derivatives liquidity to facilitate smooth trading. These entities are typically large companies, exchanges, or financial institutions that specialise in connecting buyers and sellers by filling order books and offering favourable trading conditions.

While the term is often associated with the Forex market, it is gaining significance in the world of cryptocurrency trading as well. As crypto exchanges continue to grow in popularity and volume, the need for liquidity providers that can support these markets becomes increasingly important.

One of the main services offered by institutional liquidity providers is prime brokerage. This involves connecting numerous brokers to deep liquidity pools, allowing them to access a wide range of assets and offer competitive trading conditions to their clients.

In addition to supporting traditional centralised exchanges (CEXes), some liquidity providers also assist startups in achieving high turnover rates for specific tokens. This can be especially beneficial for newly launched projects looking to increase liquidity and attract more traders.

Another type of service offered by certain liquidity providers is crypto CFD (contracts for difference) liquidity. Crypto currency CFD allows investors to profit from the price movements of cryptocurrencies without actually owning them. This type of liquidity is preferred by some brokers because it does not involve actual cryptocurrency exchanges.

Here are a few well-known companies that offer spot and derivatives liquidity services:

- NinjaPromo

- GSR Markets

- BitGo

- Galaxy Digital Trading

- Empirica

These providers cater to the needs of a variety of platforms with a variety of services.

These companies often provide CFD crypto liquidity to brokers:

- B2Broker

- Leverate

- GBE Prime

Liquidity in DeFi

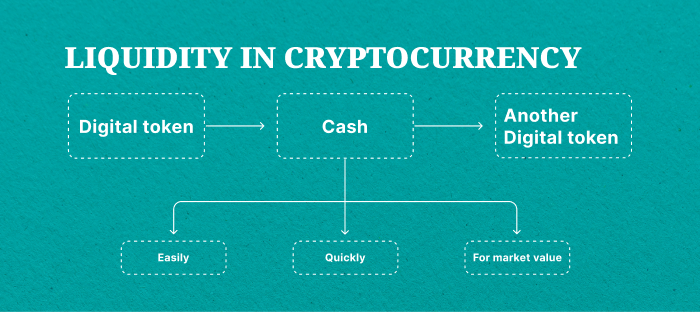

Liquidity is a crucial factor in the success of any financial market. In the realm of DeFi, liquidity pools have emerged as a popular solution to address the issue of trading liquidity on decentralised exchanges (DEXes).

At the heart of liquidity pools are AMMs, which are smart contracts that use algorithms to determine asset prices. Unlike traditional exchanges, which rely on order books and human market makers to set prices, AMMs automate this process by using mathematical equations. This enables trades to be executed without the need for a counterparty, making them more efficient and cost-effective.

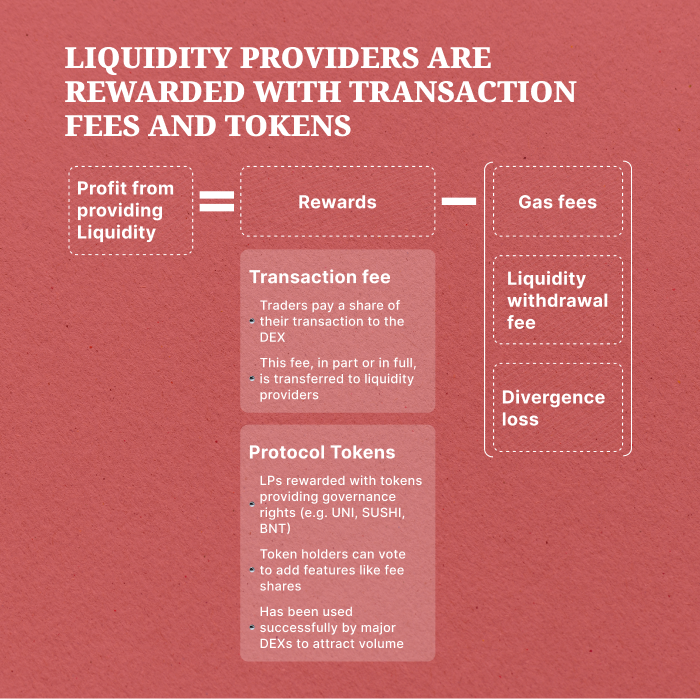

The success of liquidity pools heavily depends on liquidity providers – users who contribute their assets to the pool. LPs deposit two tokens of equal value into the pool, creating a market for those tokens. In return, they receive LP tokens proportional to the amount of liquidity they provide. These tokens represent their stake in the pool and can be redeemed for their share of the pool’s assets.

One of the key benefits of liquidity pools is that they eliminate the need for a centralised entity, such as a market maker, to provide liquidity. This decentralised approach not only allows anyone to become an LP but also enhances market efficiency by eliminating potential bottlenecks and increasing trading volume.

Popular platforms that offer liquidity pool services include:

- Balancer

- Uniswap

- Curve Finance

Ensuring Adequate Liquidity on Your Crypto Exchange

If you own a crypto exchange, providing sufficient liquidity is essential for attracting traders and maintaining a vibrant trading environment. So, what are the most common ways to ensure good liquidity on the platform?

Partnering with Liquidity Providers Firms

One way to ensure consistent liquidity on your exchange is by partnering with institutional liquidity providers, whether you want to offer spot or crypto CFD trading. By collaborating with these providers, you can improve the overall trading experience on your exchange and attract more traders.

Acting as an Interexchange Market Maker

As an exchange operator, you can also act as a liquidity provider by setting bid and ask prices for assets listed on your platform. This approach eliminates the need for third-party providers and allows you to control the liquidity of your exchange. By acting as an interexchange market maker, you can ensure competitive pricing and improve liquidity on your platform.

Integrating with DeFi Liquidity Pools

Another way to enhance liquidity on your exchange is by integrating with DeFi liquidity pools. LPs who participate in popular DeFi platforms can provide liquidity for your exchange.

Choosing a Reliable Crypto Liquidity Provider

When selecting a spot or CFD trading crypto liquidity provider, it is crucial to carefully consider your options, as it can greatly impact the success of your cryptocurrency trading activities. There are numerous factors you should take into account when conducting research on potential providers:

- Reputation and track record in the industry

- Security measures and protocols in place to protect user funds

- Trading volume and liquidity available for desired cryptocurrencies

- Efficiency and speed of order execution

- Adherence to regulatory guidelines and compliance standards

- Technological capabilities and stability of their platform

- A variety of instruments offered for trading

- Quality of price feeds used for market data

- Availability and quality of client service and technical support

- Associated fees for transactions, deposits, withdrawals, and other services offered.

Bottom Line

In conclusion, liquidity plays a crucial role in the success of any cryptocurrency exchange or project. It not only ensures efficient trading and price stability but also instils market confidence.

Remember, it is essential to carefully review and negotiate contracts with providers to protect your interests before signing any agreement. All in all, liquidity is a key factor that can make or break your spot or crypto CFD trading platform in this ever-evolving industry.