Guide

How to Remove a Bank Account on Cash App

A payment app that works similarly to Venmo is known as Cash App. It enables you to easily send money to people you know, such as friends and relatives, without the need to obtain currency, make changes, or even physically meet with each other. It’s as easy as taking out one card and replacing it with another. Taking away a debit or credit card from your wallet is not the same as detaching a bank account from your wallet. Find out how to get rid of a bank account on Cash App here.

Read Also: How to Borrow Money From Cash App

How to Remove a Bank Account on Cash App

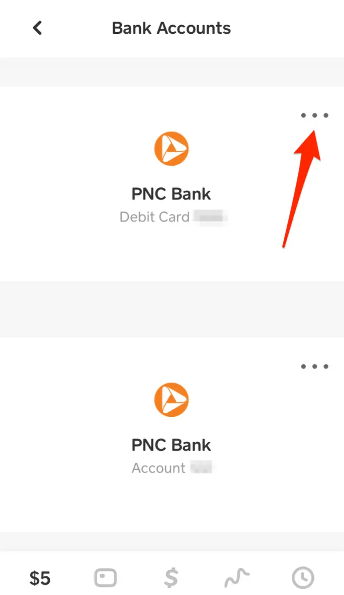

In order to delete a bank account, you must first complete the first three procedures outlined above, and then go to the next section.

1. Navigate to the section labelled “Bank Accounts,” locate the item that is titled “Account xxx,” and then tap the three dots that are located in the upper right corner.

2. Select “Remove Bank” from the drop-down menu if you want to get rid of the bank account completely. By doing this, the account will be immediately disconnected from your Cash App profile. Tap “Replace Bank” if you wish to swap out the current bank for a different one.

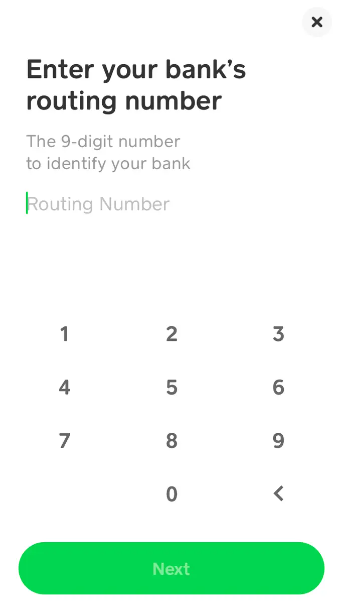

3. Enter the routing number and account number for your new bank by following the directions that appear on the screen. When you are finished, the account you currently have will be linked to the new bank.

FAQs

Can I have two bank accounts on Cash App?

You are free to link as many bank accounts as you like to your Cash App; but, before you can link another bank account, you will first need to disconnect any bank accounts that are already linked to your Cash App. Because of this, you won’t be able to manage numerous bank accounts from the same account, as it will only let you have one open at a time.

How do I change my routing number on Cash App?

Tap the Money tab located on the home screen of your Cash App. Click the routing number and account number that are located below your current balance. You can copy your account number and routing number by using the choices. When prompted during the setup process for a direct deposit for a bank account, provide both the account number and the routing number.

Does your account and routing number change when you get a new Cash App card?

In order to allow direct deposits, you will need to have an activated Cash Card. When this feature is activated on your account, you can receive up to $25,000 in a single direct transfer and up to $50,000 in total within a 24-hour period. You will be able to view your new account number along with your routing number as soon as you activate your Cash Card.

Is it legal to have two Cash Apps?

Therefore, the answer to the aforementioned question is yes; you are able to physically have two Cash App accounts if you sign up for your first Cash App account using the personal account setting or if you choose to set up a business account. Simply ensure that you utilise a distinct mobile number, bank account, and email address for each of the various accounts that you have to maintain their individuality.