News

Earnings of Apple; Tech Weakness; Growth recovering

Earings of Apple, The iPhone time is finished. In any case, how huge is the hit to Apple?

The organization is relied upon to report decreases in income and benefit following the end ringer on Tuesday. Investigators expect income in the three months finished March to fall 6% to $57.4 billion, while overall gain is estimate to decay by 20%.

Apple’s (AAPL) most concerning issue is the iPhone, which has gone wrong since clients begun recoiling from costly overhauls and purchasing less expensive telephones from Chinese contenders like Huawei and Xiaomi.

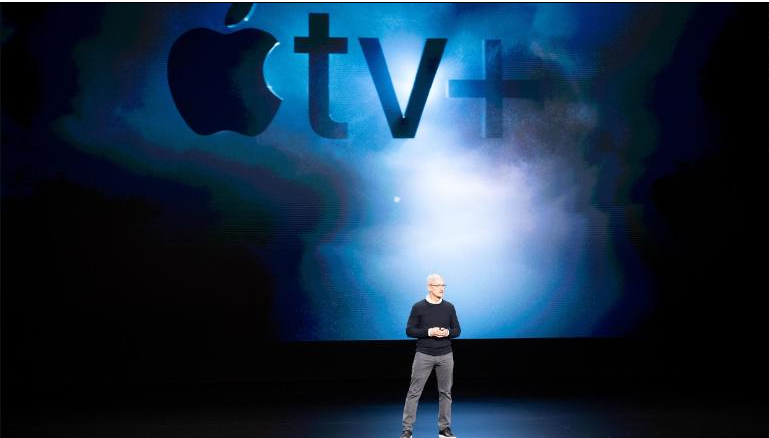

Speculators are trusting that CEO Tim Cook can discover another approach to help development. Administrations, for example, Apple Pay, Apple Care and Apple Music could be the organization’s next enormous core interest.

2. Tech shortcoming: Google (GOOGL) and Samsung (SSNLF) both frustrated financial specialists with their quarterly income.

Samsung said Tuesday that its working benefit dove 60% in the quarter to 6.2 trillion won ($5.3 billion). Deals for the three months finished March dropped 14% to 52.4 trillion won ($45 billion).

The terrible report comes seven days after Samsung postponed the dispatch of its profoundly foreseen foldable cell phone after a few analysts revealed deserts. Offers fell under 1% in Seoul.

Google parent organization Alphabet posted $36.3 billion in income for the main quarter after the US advertise shut on Monday. About 85% of that income originated from its center publicizing business.

By and large income expanded by only 17% from a similar period a year sooner, missing Wall Street gauges and raising worries that Google is feeling the challenge from Facebook (FB) and Amazon (AMZN).

Offers in Alphabet fell 7% in broadened exchanging.

3. Uplifting news from Europe: Eurozone monetary development quickened in the initial three months of the year to 0.4%, twofold the rate posted in the past quarter. Development was 1.2% on an annualized premise.

It’s the most recent proof to propose that the world’s greatest economies are stronger than numerous financial analysts suspected.

China beat desires by posting first quarter development of 6.4%, and the US economy developed at a greatly improved than anticipated rate of 3.2%.

4. More from Milken: The Milken Institute’s yearly Global Conference proceeds in Los Angeles. The current year’s subject is “Driving Shared Prosperity.”

Speakers booked for Tuesday incorporate Citadel author Ken Griffin and White House Acting Chief of Staff Mick Mulvaney.

CNN Business will have live inclusion from the occasion.

5. Worldwide market diagram: US stock fates were minimal changed.

European markets opened lower. Stocks in Asia were blended. The Shanghai Composite included 0.5% regardless of frustrating assembling information in China.

The S&P 500 and the Nasdaq completed at record levels on Monday subsequent to posting little gains. The Dow squeezed out an addition of under 0.1%.

Prior to the Bell bulletin: Key market news. In your inbox. Buy in now!

6. Profit and financial aspects: Baker Hughes (BHGE), (BP), ConocoPhillips (COP), Eli Lilly (LLY), General Electric (GE), General Motors (GM), MasterCard (MA), McDonald’s (MCD), Pfizer (PFE) and Phillips 66 (PSX) are discharging income before the open.

Apple (AAPL), Denny’s (DENN), Groupon (GRPN) and Mondelez International (MDLZ) are up after the nearby.

US purchaser certainty and pending home deals are expected at 10:00 a.m. ET.

7. Coming this week:

Tuesday — Eurozone GDP; Fed meeting begins; China fabricating PMI; (GM), GE and Apple income

Wednesday — Fed choice; Yum Brands (YUM) and (CVS) profit

Thursday — Bank of England arrangement update; Under Armor (UA) and Dunkin’ (DNKN) profit; week after week jobless cases; Caixin China fabricating PMI

Friday — Jobs report; Eurozone expansion, Fiat Chrysler (FCAU) profit