Cryptocurrencies

What is Blockchain Technology and How Does it work

The technology behind blockchains is likely to be one of the most talked-about developments of the 21st century. Blockchains were first developed to support Bitcoin, but they now power dozens of other cryptocurrencies. Developers are focusing on integrating the technology into several industries, including the medical field, the art world, and the financial sector.

It may be beneficial to have an understanding of how blockchain technology operates, the reasons why it is valuable, and what sets it apart from other internet technologies in order to comprehend the expanding interest in the subject.

What Is a Blockchain?

A distributed database or ledger that is shared across al

l of the nodes of a computer network is referred to as a blockchain. A blockchain may be thought of as an electronic database that holds information in a digital format. Blockchains are perhaps best recognised for their vital function in cryptocurrency systems like Bitcoin, in which they are used to keep a public ledger of transactions that is both safe and decentralised. The innovation that is brought about by a blockchain is that it ensures the accuracy and safety of a record of data and establishes confidence without the need of a third party that can be relied upon.

The way in which data is organised is one of the primary distinctions that can be drawn between a traditional database and a blockchain. A blockchain organises the data it stores into groups, which are called blocks, and each block may store a specific set of data. When a block’s storage capacity is used up, it is sealed off and connected to the block that came before it. This creates a chain of data that is referred to as the blockchain. Blocks have varying capacities. All of the newly received data that comes after a block that has just been added to the chain is assembled into a newly formed block, which, after it is complete, is likewise added to the chain.

With a database, the data is often organised into tables, however in a blockchain, the data is organised into chunks (blocks) that are linked together. This is how the blockchain gets its name. When implemented in a decentralised manner, this data structure inevitably generates an irreversible data timeline. When a block is completely filled, the information contained inside it is immutable and is added to this timeline. When a new block is added to the chain, that block immediately receives a timestamp that is accurate to the second.

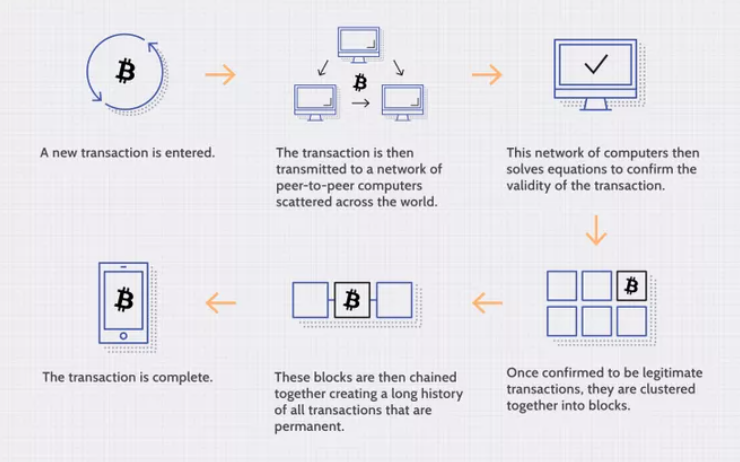

How Does a Blockchain Work?

The objective of blockchain technology is to make it possible to preserve and disseminate digital information while preventing its modification in any way. In this sense, a blockchain serves as the basis for immutable ledgers, which are essentially recordings of transactions that cannot be changed, erased, or otherwise destroyed. Because of this, blockchains are also sometimes referred to as a kind of distributed ledger technology (DLT).

The blockchain idea was initially presented in 1991 as part of a research project, making it older than its first mainstream use, Bitcoin, which was released in 2009. Since that time, several cryptocurrencies, apps for decentralised finance (DeFi), non-fungible tokens (NFTs), and smart contracts have been developed, which have all contributed to an explosion in the usage of blockchain technology.

Transaction Process

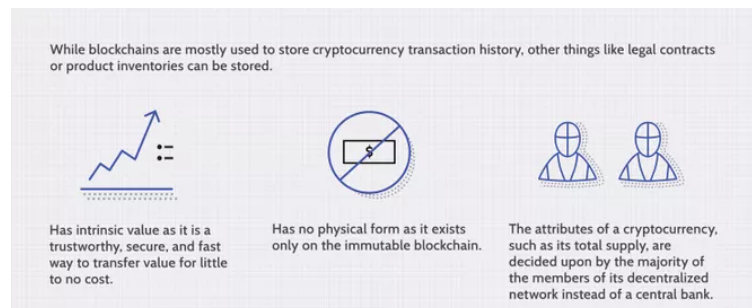

Attributes of Cryptocurrency

Blockchain Decentralization

It’s possible to have 10,000 computers running a database that contains all of a company’s customers’ account information. It controls the warehouse where all of these computers are located, and it has complete access to the data on each of those machines and every piece of information they hold. It’s a single point of failure, though. What will happen if the power goes out at that location? What would happen if its Internet connection was cut off? What if it all goes up in flames? How devastating would it be if a malicious actor were to delete everything in a matter of seconds? In any instance, the data is either lost or distorted, and it cannot be recovered.

Using a blockchain, a database may be dispersed over several network nodes in different places. As a result, the data in the database is protected against tampering since any changes made to one of the nodes will not affect the others, preventing a bad actor from altering the records. If a single user tampers with the history of Bitcoin transactions, the rest of the network will be able to readily identify the offending node. Using this technique, it is possible to construct a precise and clear sequence of occurrences. There is no way for a single node in the network to modify the information stored in it.

Data and history (such as transactions in a cryptocurrency) are indestructible as a result. Recording transactions is one possibility; however, a blockchain may also store other types of data, including legal contracts, state identifications, and goods inventories.

Transparency

As a result of Bitcoin’s blockchain’s decentralised structure, anybody may witness all transactions in real time by either running a personal node or utilising blockchain explorers. When a new block is verified and added, the chain on each node is automatically updated. As a result, it’s possible to keep tabs on Bitcoin’s movements at all times.

Bitcoin holders who had their funds in an exchange at the time of the attack were left with nothing. While the hacker may be completely anonymous, the Bitcoins they stole may be traced back to them. If any of these hackers’ stolen Bitcoins were relocated or spent someplace, the location would be known.

Bitcoin blockchain records, as well as most others, are encrypted, of course. This implies that only the record’s owner may decode it and learn its contents, such as its owner’s name (using a public-private key pair). This allows blockchain users to maintain their anonymity while yet maintaining transparency.

Is Blockchain Secure?

Decentralized blockchain security and trust may be accomplished in several ways. All new blocks are ordered chronologically. They’re usually added “last” Changing a block’s contents after it’s been added to the blockchain is impossible unless a majority of the network agrees. Each block contains a hash, the previous block’s timestamp, and a unique timestamp. Mathematical formulas translate digital data into numbers and letters. Changing the data changes the hash code.

A hacker who maintains a blockchain node plans to modify the chain and steal bitcoin. If they edited their copy, it wouldn’t be compatible with the group’s. This one copy will stand out, and the hacker’s chain will be tossed out.

At least 51% of blockchain copies must be owned and updated simultaneously by the hacker to make their new copy the majority copy and agreed-upon chain. Due to the various timestamps and hash codes from an attack, it would be expensive to replicate all the blocks.

Many bitcoin networks are too vast and fast-growing to do this. Money, time, and effort would be wasted. If they attempted such a modification, network members would be frightened. Network members may switch to a new, bug-free copy of the chain. The attacked token’s value would plummet, making the attack useless for the evil actor. The next Bitcoin split would be targeted in the same way. The network was structured such that participating is more financially lucrative than attacking.

Bitcoin vs. Blockchain

Stuart Haber and W. Scott Stornetta developed blockchain in 1991 to prevent document timestamp tampering. Blockchain didn’t have a real-world use until Bitcoin launched in January 2009. 1

Bitcoin uses blockchain. Bitcoin’s developer, Satoshi Nakamoto, introduced it as “a novel peer-to-peer electronic cash system with no trusted third party” 2

Bitcoin utilises blockchain to record a transparent log of payments, but blockchain may store any amount of data points immutably. This includes transactions, votes, goods inventories, state IDs, house deeds, and more.

Tens of thousands of initiatives want to use blockchains for more than simply documenting transactions, such as voting securely in democratic elections. Blockchain’s immutability makes fraudulent voting harder. A voting system might provide each citizen a coin or token. Each candidate would be given a wallet address, and voters would send their token to that address. Blockchain’s transparency and traceability would remove human vote counting and ballot tampering.

How Are Blockchains Used?

Bitcoin’s blockchain stores transaction data in blocks. There are around 10,000 blockchain-based cryptocurrencies now. Blockchain may store data about other sorts of transactions, too.

Walmart, Pfizer, AIG, Siemens, Unilever, and others have used blockchain. IBM’s Food Trust blockchain tracks food goods’ journeys. 3

Pourquoi? The food industry has seen numerous E. coli, salmonella, and listeria outbreaks and accidental contamination. In the past, it took weeks to find outbreak sources or food-borne illness causes. Using blockchain, brands can track a food product’s origin, stops, and delivery. If a food is contaminated, it can be traced to its origin. These companies can now see everything else they’ve come in contact with, allowing for earlier problem identification and potentially saving lives. There are many other ways to use blockchain.

Banking and Finance

Banking might gain the most from blockchain technology. Financial institutions are open Monday through Friday during business hours. If you deposit a check at 6 p.m. on Friday, the money won’t touch your account until Monday. Even if you deposit during business hours, the transaction might take one to three days to verify owing to bank activity. Blockchain works 24/7.

By integrating blockchain into banks, users may have their transactions executed in as little as 10 minutes, regardless of holidays or day of week. Banks can trade money more swiftly and securely using blockchain. In stock trading, the settlement and clearing process can take up to three days (or longer if trading internationally), freezing money and shares.

Even a few days of money in transit can be costly and risky for banks given the amounts involved.

Currency

Bitcoin relies on blockchain technology. Fed controls dollar. Under this arrangement, a user’s data and cash are at the bank or government’s will. If a user’s bank is hacked, confidential data is at danger. If a client’s bank fails or they reside in an unsafe nation, their currency may be at danger. In 2008, taxpayers bailed out failing banks. Bitcoin was created out of these fears.

Blockchain enables Bitcoin and other cryptocurrencies to function without a central authority. This reduces risk and transaction expenses. It may provide nations with unstable currencies or financial infrastructures a more stable currency with more uses and a bigger network of persons and organisations with which to conduct business.

Those without state ID may save or pay using bitcoin wallets. Some nations are war-torn or lack identification infrastructure. Such nations may not provide savings or brokerage accounts, thus its citizens can’t securely hold money.

Healthcare

Blockchain can safeguard medical records for healthcare providers. When a medical record is produced and signed, it may be put onto the blockchain, giving patients confirmation that it cannot be modified. Personal health records might be encoded and saved on blockchain with a private key, assuring anonymity.

Property Records

If you’ve ever visited your local Recorder’s Office, you know documenting property rights is cumbersome and inefficient. Physical deeds must be handed to a government official at the local recording office, where they are manually put into the county’s central database and public index. Property claims must be balanced with the public index in a property dispute.

This technique is expensive, time-consuming, and prone to human mistake, making property ownership monitoring less efficient. Blockchain might remove the need to scan papers and find actual files at a recording office. If property ownership is validated on the blockchain, owners may believe their deed is true and everlasting.

In war-torn nations or locations without a Recorder’s Office, it might be difficult to verify property title. If a community can use blockchain, property ownership timelines may be made transparent and unambiguous.

Smart Contracts

A smart contract is computer code incorporated into the blockchain to verify or negotiate a deal. Smart contracts have user-agreed terms. When these requirements are satisfied, the agreement is implemented.

Say a renter wants to rent an apartment using a smart contract. After receiving the security deposit, the landlord gives the renter the apartment’s door code. Both the renter and the landlord would transmit their shares of the agreement to the smart contract, which would automatically swap the door code for the security deposit on the lease start date. Smart contract returns security deposit if landlord doesn’t provide door code by lease date. This would remove notary, mediator, and attorney costs and procedures.

Supply Chains

As with IBM Food Trust, suppliers may utilise blockchain to record material provenance. This would enable firms to validate their goods and popular labels like “Organic,” “Local,” and “Fair Trade.”

Forbes reports that the food business is implementing blockchain to trace food from farm to consumer.

Voting

Blockchain might be utilised for a contemporary voting system, as suggested. Voting using blockchain might reduce election fraud and raise voter participation, as demonstrated in West Virginia in November 2018. 5 Blockchain would make voting virtually difficult to manipulate. The blockchain system would also ensure electoral openness, eliminating manpower and offering practically quick results. This would remove the need for recounts and fraud concerns.

Pros and Cons of Blockchain

Despite its intricacy, blockchain’s decentralised record-keeping potential is almost limitless. Blockchain technology might be used to increase user privacy and security, reduce processing costs, and reduce mistakes. There are downsides.

Pros

- Removed the need for human intervention in the verification process.

- By reducing the need for third-party verification, costs may be reduced.

- In a decentralised system, it is more difficult to interfere with

- A safe and confidential way to do business is now available.

- Open-source software

- Citizens in nations with unstable or insecure banking systems may now have access to a banking alternative and the ability to protect their personal information.

Cons

- Bitcoin mining has a high technical barrier to entry.

- Transactions per second that are slow to occur

- It has a long history of unlawful usage, including on the dark web

- Regulations vary from jurisdiction to jurisdiction and remain hazy in many cases.

- Limitations on the amount of storage space available

Benefits of Blockchains

Accuracy of the Chain

There are hundreds of machines on the blockchain network that verify transactions. As a consequence, there are less opportunities for human mistake and a more accurate record of the data. One copy of the blockchain would be affected even if a network machine were to commit a computational error. Bitcoin’s network is so huge and expanding that it would be almost impossible for the mistake to propagate throughout the whole blockchain unless at least 51 percent of its machines made it. 6

Cost Reductions

When a customer wants to verify a transaction, a notary or a minister usually charges a fee. Third-party verification and the related expenditures it entails are no longer necessary thanks to the advent of the blockchain. Small fees are incurred when businesses accept credit card payments because banks and payment-processing providers must handle the transactions. While Bitcoin does not have a central authority, it does not charge transaction fees and has a low transaction volume.

Decentralization

There isn’t a single point of storage for information on the blockchain. Instead, a network of computers copies the blockchain. Blockchains are automatically updated whenever a block is added to the system. Rather of keeping such information in a single database, blockchain makes it more difficult to tamper with. If a hacker had a copy of the blockchain, they would only have access to a single copy of the data, rather than the whole network.

Efficient Transactions

It might take up to a few days for transactions made via a central authority to be processed and settled. If you deposit a check on a Friday evening, you may not see the money in your account until Monday morning, depending on when you deposit the check. Blockchain, on the other hand, works around the clock, seven days a week, and 365 days a year, unlike financial institutions that function during business hours. Transactions may be performed in only 10 minutes and are safe after just a few hours. Especially beneficial for cross-border transactions, which often take longer due to time zone differences and the fact that all parties must approve payment processing.

Private Transactions

It is possible for anybody with an Internet connection to see the transaction logs of several blockchain networks. Transaction data are available to all users, but identifying information about the people who made the transactions is not. A popular misconception is that blockchain networks like bitcoin are completely anonymous, whereas in reality they are only confidential.

A user’s unique code, referred to as a “public key,” is recorded on the blockchain when they conduct a public transaction. It does not include any of their personal data. A person’s identity is still connected to their blockchain address if they acquire Bitcoin on an exchange that needs identification, but a transaction does not expose any personal information even when it is attached to a person’s name.

Secure Transactions

The blockchain network must verify the legitimacy of a transaction once it has been recorded. Blockchain computers race to verify that the purchasing data are accurate. The transaction is added to the blockchain block when a machine verifies it. When a new block on the blockchain is added to the chain, the previous block’s unique hash is also included. The hash code of a block changes if any of the information on the block is changed, while the hash code of the block after it does not. Because of this disparity, it is incredibly difficult to update information on the blockchain.

Transparency

Open-source software is the norm when it comes to blockchains. Since it’s open to the public, anybody may look at its source code. This allows auditors to examine the security of cryptocurrencies like Bitcoin. The lack of a central authority over Bitcoin’s code and how it is modified also implies that no one can really be trusted. As a result, anybody may make suggestions for improvements or new features to the system. It is possible to upgrade Bitcoin if the majority of the network’s users believe that the new version of the code includes an improvement that is sound and valuable.

Banking the Unbanked

Anyone from any background may utilise blockchain and Bitcoin, which is perhaps the most significant aspect of these technologies. An estimated 1.7 billion individuals do not have access to a bank account or any other kind of financial storage, according to the World Bank. 7 As the economy in developing nations is still in its infancy, most of these people reside there.

It is not uncommon for these persons to get compensated in cash. In order to protect themselves from robbery or needless violence, they must conceal this cash in secret areas in their houses or other places of residence. On paper, on a cheap mobile phone or even memorised if required are various ways to keep the private keys to a Bitcoin wallet. As a general rule, these solutions are easier to conceal than a few dollars stashed beneath the mattress.

Blockchains of the future are also exploring for ways to store medical information, property rights, and a wide range of other legal transactions in addition to wealth storage.

Drawbacks of Blockchains

Technology Cost

Although blockchain may save customers money by reducing transaction costs, the technology is not completely without cost. Bitcoin’s PoW technique for verifying transactions, for example, needs a lot of processing resources. A year’s worth of electricity from the bitcoin network’s millions of computers would power Norway and Ukraine for a year. 8

To verify transactions on the blockchain, consumers continue to increase their power consumption. Miners are compensated with enough bitcoin to make their efforts profitable when they add a block to the bitcoin network. However, in blockchains without money, miners will need to be compensated or otherwise motivated to confirm transactions.

It seems that some answers to these problems are on the way. Some bitcoin-mining operations employ solar power, natural gas from drilling waste, or wind turbines to generate electricity.

Speed and Data Inefficiency

The potential inefficiencies of the blockchain can best be studied in the context of Bitcoin. A new block is added to the Bitcoin network every 10 minutes using the PoW mechanism. 9 About seven transactions a second may be handled at this pace, according to estimates from the blockchain (TPS). Although Ethereum and other cryptocurrencies perform better than bitcoin, they are still constrained by the blockchain. To put things in perspective, Visa’s legacy system has a TPS of 65,000. 10

Efforts to solve this problem have been ongoing for years. There are presently more than 30,000 TPS blockchains in existence. 11

Because each block can only carry so much info, there is another problem. When it comes to blockchain scalability, block size has been and will continue to be one of the most contentious problems.

Illegal Activity

In order to protect users from attacks and maintain privacy, the blockchain network provides anonymity and secrecy. One of the most often cited examples of unlawful transactions using blockchain technology is Silk Road, a dark web illegal-drug and money laundering bazaar that operated from February 2011 until October 2013. 12

Using the Tor Browser and other dark web currencies, users may buy and trade illicit things on the dark web anonymously. When a new account is opened, financial institutions in the United States are required by law to collect information about their clients and validate their identities, as well as make sure they aren’t listed as members of terrorist groups. 13 There are both advantages and disadvantages to this arrangement. It makes bank accounts accessible to everybody, but it also makes it easier for thieves to do their business. Many have claimed that the positive applications of cryptocurrencies, such as providing financial services to the unbanked, outweigh the negative ones, particularly in light of the fact that the majority of illicit activities are still carried out using anonymous cash.

Bitcoin’s transparency and maturity as a financial asset have actually led to illicit behaviour moving to other cryptocurrencies like Monero and Dash.

14 Only a tiny percentage of all Bitcoin transactions are used for unlawful purposes today. 15

Regulation

Cryptocurrency enthusiasts worry about government control of the industry. Since Bitcoin’s decentralised network is becoming more difficult to shut down, governments might conceivably deem ownership of cryptocurrencies or participation in their networks illegal.

Large corporations like PayPal are allowing cryptocurrency ownership and usage on their platforms, reducing this worry over time.

What Is a Blockchain in Simple Terms?

A shared database or ledger is what a blockchain is at its core. Each node in the network has an identical copy of the complete database, which is stored in blocks of data. Because only one copy of the ledger may be edited or deleted at a time, the majority will not reflect the change and will be rejected, ensuring the ledger’s security.

How Many Blockchains Are There?

Every day, the number of active blockchains increases at an exponential rate. By the year 2022, there will be more than 10,000 active bitcoin blockchains and hundreds of other non-cryptocurrency blockchains.

What’s the Difference Between a Private Blockchain and a Public Blockchain?

A permissionless or open blockchain, often known as a public blockchain, allows anybody to join and run a node on the network. These open blockchains must be protected by encryption and a consensus technique like proof of work because of their open nature (PoW).

Nodes must be pre-approved to join a private or permissioned blockchain. There are fewer levels of security since nodes are deemed to be trustworthy.

FAQ’s

What is blockchain example?

Examples of blockchains include Bitcoin and Ethereum. The blockchain may be accessed by anybody and used for transactions.

What is the biggest blockchain company?

One of the world’s leading cloud platform and cognitive solutions companies, IBM was founded in 1911. More than 220 companies have benefited from IBM’s assistance in creating blockchain-based apps and data governance solutions.

What is blockchain in real life?

There are many more uses for blockchain technology than just money and bitcoin. The technology is having an influence on a wide range of industries, from contract enforcement to streamlining government operations, thanks to its capacity to increase justice and transparency while also saving firms time and money.

The Bottom Line

Because of bitcoin and cryptocurrencies, blockchain is finally earning a reputation for itself, thanks in no little part to the technology’s numerous practical uses. It’s no surprise that blockchain has become a term in the minds of investors around the country, since it has the potential to improve corporate and government processes in a number of ways.

It’s no longer a matter of if, but when traditional corporations will adopt blockchain technology as we enter the third decade of its existence. NFTs and asset tokenization are becoming more commonplace nowadays. The next several decades will be critical for blockchain’s development.