Guide

How To Invest In Real Estate With Little Money

You may be asking how you could possibly invest in real estate with a little amount of money or perhaps none at all. Although it is true that investing in real estate is a kind of asset class that, in most cases, needs money in order to generate money, there are methods to get started in this field even if you do not have a significant amount of cash available to you. In this post, I will demonstrate ten different approaches to real estate investing that need a little initial investment on your part.

10 Way to Invest in Real Estate with Little Money

1. “House Hacking”

Although it’s not for everyone, home hacking is often a good way to get started in the world of hacking. Using this technique, you will be able to:

- Rather of purchasing a single-family home for your main house, consider investing in a multi-family building instead.

- After that, you rent out the other apartments in the building and use the rent money from those units to pay down your mortgage and any other costs associated with maintaining the whole property.

- You’ll be able to put away more cash for a down payment on the next house you buy as an investment if you don’t have to shell out money for rent now.

Because you intend to utilise the home as your main residence after acquiring it, you should be able to get approval for an FHA loan, which will allow you to finance your house-flipping approach with a down payment of just 3.5% of the purchase price. The number of units is one of the factors that determines whether or not you are eligible for an FHA loan. Most lenders restrict residential funding to properties with four units or fewer, but there are also requirements regarding your income and credit, as well as the characteristics of the property and its location.

It is possible to buy a home for investment with very little money out of pocket and then “house hack” it so that it may serve as your main dwelling. In an ideal scenario, you want to make sure that the total revenue from rentals is sufficient to pay all of the costs associated with ownership. These costs include a vacancy allowance, taxes, and insurance premiums.

2. Live-in, Then Rent

Putting off the purchase of your “dream house” in favour of investing in a less costly property that would function admirably as a rental unit is yet another strategy for getting started. After living there for a few years, you may convert your rental home into an investment that brings you money.

Because this would be your main house, you will almost certainly be eligible for an FHA loan, which comes with a very attractive interest rate. This is one of the most significant benefits of this plan (instead of the higher interest rate lenders charge on investment properties).

A conventional mortgage for a rental property often needs a down payment of twenty percent of the purchase price, whereas an FHA loan typically only requires a down payment of three and a half percent. In addition, if you are a veteran, you are eligible for a VA loan, which enables you to purchase a house with no initial deposit required.

Additionally, when you move on, you can keep the same FHA loan by finding tenants to cover your mortgage, insurance, and maintenance costs, and you can qualify for an FHA loan again on your next home if you make it your new primary residence. This is only possible if you make the new home your primary residence.

3. Live-in House Flips

If you are the kind of person who is good with their hands and don’t mind living in a construction zone, you may buy a home that needs some work. You purchase the property, then move in, do the necessary renovations, and ultimately sell it for the highest possible price.

This technique does involve money, both for the initial purchase and for the renovations that will be necessary. However, since you are living in the house, the money that you would have spent on rent is now being “invested” in the property and contributing to your equity. Your efforts may accumulate a significant amount of “sweat equity.”

If you don’t have the expertise to conduct part of the remodelling work yourself, you’re going to end up paying an excessive amount. You should also educate yourself on the market to guarantee that the upgrades and updates you make will be profitable for you in the long run. The goal is to make the property more appealing to potential buyers, so you shouldn’t put in high-end additions that appeal to you personally. When you keep all of this information in mind, you position yourself to extract the most possible amount of equity from your home when you sell it.

4. Real Estate Crowdfunding

Another method that allows you to include real estate investments in your portfolio even if you do not have a significant amount of funds to invest is crowdfunding.

You may invest in huge commercial projects that are bought and managed by experienced real estate developers by using internet crowdfunding platforms to combine your money with the funds of a large number of other small investors. Lending money to a real estate developer for use in the development of a certain property over the course of a predetermined period of time qualifies as a relatively passive method of investing in real estate.

The minimal investment required to participate in several platforms has recently become less stringent. In point of fact, all you need to get started is $500. Through Roofstock’s online crowdfunding platform, you may even purchase and finance a full turnkey rental property on your own. Roofstock will handle everything for you.

Bear in mind that the majority of crowdfunding sites won’t allow you to invest with them unless you can prove that you are qualified to do so.

5. Real Estate Investment Trusts

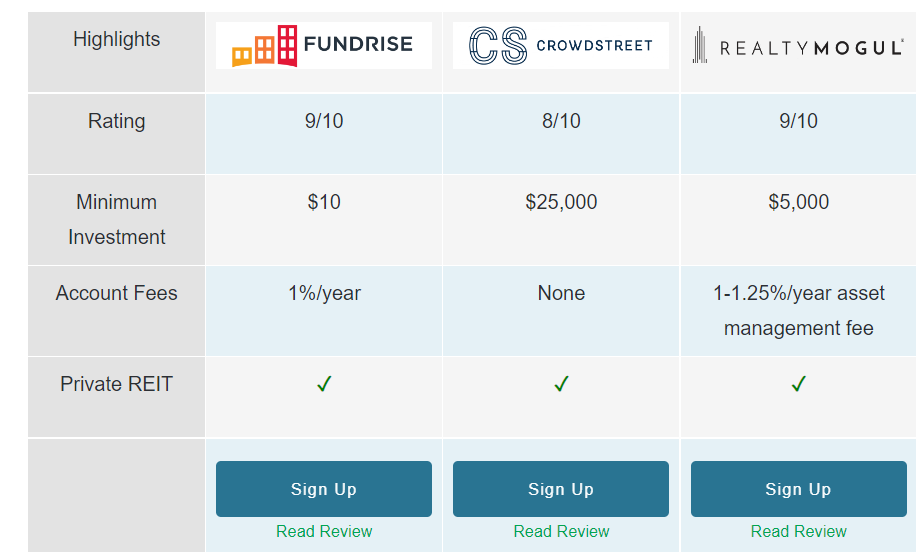

Investing in real estate via real estate investment trusts, or REITs, is an alternative to purchasing individual properties. The best part is that you don’t need a lot of capital to invest in a REIT. Consider a real estate investment trust (REIT) to be a pool of real estate assets that are managed by an experienced real estate professional and freely exchanged on the stock market exchange. Real estate investment trusts (REITs) provide investors with some of the same benefits as stocks provide. In many cases, you may invest with very low minimums by purchasing fractional shares. For instance, Fundrise has a Real Estate Commitment Trust (REIT) that requires a minimum investment of $500.

Passive real estate investors may find REITs to be an attractive option because of their low risk profile and ability to diversify their holdings over a wide range of property types and geographical areas. There are real estate investment trusts (REITs) that provide dividends, which means you may include them in your income portfolio. Investing in real estate investment trusts (REITs) allows investors to profit from the often greater returns generated by real estate assets without having to own or manage any physical properties.

6. Borrow Your Down Payment, But Be Cautious

Borrowing the whole amount of money necessary to purchase a house is a dangerous endeavour, as everyone who was around during the aftermath of the housing bubble a decade ago probably still remembers. Lenders will tell you that you are unable to borrow the money for your down payment.

Nevertheless, there are methods to do this. You have the option of withdrawing money from your 401(k) and taking out a loan against your own retirement assets. When you borrow money from yourself, you are effectively acting in the role of the creditor; hence, most lenders will not consider the payment against your total debt load when determining whether or not you are qualified for a mortgage. Borrowing money from your 401(k) will, of course, lower the amount of money you have saved for retirement. In addition, if you quit your job, you may be required to repay the loan in full and/or be subject to tax penalties.

You may be able to borrow the money for your down payment if you prepare ahead of time and become creative about how to get past the criteria of the lender. If you find yourself in a financial bind, one option is to get a personal loan and deposit the money directly into your bank account. After allowing it to remain in your account for a few months, you may then submit an application for a mortgage. After a certain amount of time has passed, the lender is going to regard the funds that are now in your account as “yours.” You may be able to use those borrowed monies as your first payment on the house.

7. Master Lease Option (MLO)

This is a difficult technique, and it is more popular for bigger assets like as an apartment building or commercial property. However, it is possible to use it for smaller investments as well. This is how BiggerPockets.com’s creator, Brandon Turner, first got started in the real estate investment business with no money at all.

He was able to make contact with the owner of an apartment complex who want to have less involvement in the management of the property. The owner and Brandon came to an agreement to enter into a master lease option, also known as an MLO. Under this arrangement, Brandon would be responsible for leasing and managing the property, paying all of the property’s expenses (including taxes, maintenance, and insurance), and subletting the property to tenants. The owner receives a share of the rent that is paid by the renters each month. Brandon saved the remainder of the money and put it into savings for the down payment on the home he planned to buy from the owner, who was also the lessor.

With an MLO, in most cases, you will have the opportunity to purchase the property even while you continue to lease it and manage it on the owner’s behalf. In the transaction involving Brandon, the owner of the property finally sold it to him via the buy option that was included in the initial transaction. This tactic is somewhat similar to seller financing; however, throughout the time of the MLO, neither ownership nor title will be transferred.

8. Wholesale Properties to Investors

Consider the signs on the side of the road that appear like they were made by amateurs and say “we buy properties.” Then consider the postcard you received in the mail that offered “a lump sum cash payment for your property in 30 days with no showings or closing charges.” You discover motivated sellers as a wholesaler, and you make them an offer to purchase their property for cash within the next thirty days. However, you are not the one who really comes up with the cash.

Instead, you negotiate a cash price in “as is” condition and issue them with a “assignment” contract. This gives you time to find a cash buyer who is willing to purchase the home for the sum you promised the seller (plus your fee), and then you “assign” the contract to the cash buyer.

You need to know what cash price will make the seller happy while yet giving enough “spread” for a rehabber to make a profit after he pays the purchase price, renovations and repairs, holding fees, and selling charges in order to be successful in this business. You will need to be able to precisely estimate the figures (such as repair expenses, property market values before and after repair, closing fees, and so on), as well as be a skilled negotiator, in order to accomplish this goal. In addition, you will need to be aware of the local markets. Wholesaler fees often range between $5,000 and $15,000 per transaction on average. Some wholesalers earn between $25,000 and $30,000 each transaction on average.

You will need a lot of hustle if you want to be successful, and you will also need a budget for promotion. The majority of wholesalers discover motivated sellers by sending direct mail and making cold calls.

9. Bird Dog (Sniff Out Deals for Others)

To “bird dog,” you really don’t need any money, and you won’t have to worry about any of the risks that come along with owning an investment property on your own.

This phrase originates from the world of hunting. Dogs are very helpful to hunters, both in locating game and in retrieving it once it has been shot. As an investing bird hound, your job is to hunt out and identify potential business prospects. This practise is sometimes referred to as “driving for bucks.” You put in a lot of miles on the car as you search for homes that seem to be unoccupied or in need of repair.

You do some preliminary research, take some photographs of the outside of the property and the surrounding area, and then sell the leads to investors that specialise in wholesale transactions or fix-and-flip deals in return for a finder’s fee. Naturally, the cost is up to negotiation, and, depending on where you reside, how much research you do, and other criteria, you may make something in the neighbourhood of $1,000 each time an investor is able to transform your lead into a sale. You do not need money to begin started; nevertheless, you will need to build a network of investors to whom you can transfer leads and negotiate fees with individually. While you do not need money to get started, you will need to do so.

10. The BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Method

A property that is in significant need of repair may be purchased at a lower price using this method of investing in real estate, and then the property can be renovated to meet the requirements of rental properties. After that, you find tenants to pay the expenses of acquisition and ownership, and you refinance the property into a loan at the after-repair value (ARV) so that you may access cash to acquire another foreclosed property and begin the process all over again. You start by purchasing rental properties, then you fix them up, find tenants, then you refinance them, and you keep doing this until you have a portfolio of rental properties that generates the appropriate amount of passive income each month.

It doesn’t seem to be too difficult, does it? Before you begin, there is a lot of information that you need to understand, such as what has to be remodelled and how much it will cost, how much rent you are allowed to charge, what a good bargain looks like, how to assess the ARV, etc. You are going to need a down payment to acquire your first foreclosed home, and you are going to need money to complete the rehabilitation work on the property. The method also demands a considerable amount of start-up capital. You will need to locate alternative financing, such as hard money, which is more costly and has to be incorporated into your budget since standard lenders normally will not finance a property that requires a significant amount of repair.

The BRRRR technique may be used to generate dependable income that is mostly passive and can also serve as a revolving mechanism for endlessly acquiring other rental properties if it is implemented appropriately. It is difficult to implement the BRRRR technique in Maryland due to the high property transfer and deed registration taxes in the state, as well as the fact that the BRRRR method requires you to pay these taxes twice (when you acquire the distressed property and when you refinance).

Do your homework before diving in to ensure that this is the most effective tactic to use in the region in which you reside. In places where there is neither price inflation nor advantageous tax legislation, it is superior.

Video Guide

Final Thoughts

Every serious investor has to have some exposure to the real estate market as part of their portfolio in order to achieve the optimal level of diversity. When most people hear the word “real estate investor,” the first thing that comes to their minds is the ownership and management of rental properties. However, there are other, more passive methods to invest in real estate that are also less costly. It is essential to put in the effort to do some study and choose a path that piques your interest. You may get your feet wet in the world of real estate investment by using one of the ten approaches described in this article.